Dear Fellow Shareholders,

In 2024, the oil and natural gas industry continues to face challenges. Today’s market remains oversupplied, with production peaking in late 2023 following significant capital expenditures in response to the pandemic’s low investment cycle and Russia’s invasion of Ukraine. In addition, this past winter’s milder temperatures brought low heating demand, leaving natural gas storage levels 40% above their five-year averages.

Chesapeake was built for this moment. While market dynamics are resulting in cyclical lows for natural gas prices, demand is expected to rise materially over the next several years. In the U.S., growing markets of data centers and AI tools are requiring more electricity, and power generators are increasingly looking to natural gas to supply the base load. Globally, the U.S. is preparing to connect its natural gas production to underserved markets by building liquefied natural gas (LNG) terminals, of which nearly 12 bcf/d is currently under construction.

Our pending merger with Southwestern Energy will create a substantial opportunity to respond to evolving market dynamics and help connect crucial natural gas resources to consumers in need.

We will have an unparalleled U.S. natural gas portfolio — an investment grade-quality company with expansive access to premium markets and the ability to seamlessly move capital and best operating practices across basins.

Simply put, our combined company will deliver more gas to more markets more efficiently. As we look to the future, together we will materially advance the strategic pillars defined by Chesapeake.

Chesapeake comes into the merger from a position of strength. Our strategic actions over the last three years have built a more resilient company focused on shareholder value.

- Acquisitions of Vine and Chief: Consolidated key offset positions in Haynesville and Marcellus allowing cost reductions and efficient development of additional resources

- Divestitures of Powder River Basin and Eagle Ford: Exited assets with limited actionable inventory economic in today’s market conditions; proceeds provided significant balance sheet strength and return to shareholders

- Pausing Turn-in-Line (TIL) of New Wells (2024): Leveraged financial strength to reduce natural gas sales volumes in oversupplied market; retaining capacity to sell when demand recovers

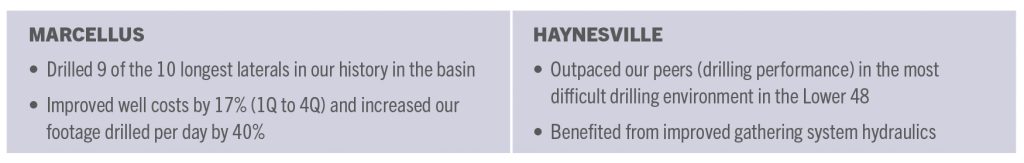

Targeting our two core assets in 2023, we delivered tangible results with bottom line impact — demonstrating the operational excellence which has come to define Chesapeake.

Most importantly, we accomplished these operational milestones while improving our combined TRIR by 40%, to an industry-leading 0.14. We also continued to reduce our GHG emissions with a focus on methane, decreasing our methane emissions intensity by more than 80% compared to our 2020 baseline.(a) Our year-end 2023 methane emissions intensity was 0.015%, substantially below the industry standard of 0.20% (as defined by the Oil and Gas Climate Initiative).

We will bring this same commitment, strategy and decision-making to the new company, post-merger. We have the portfolio, balance sheet and demonstrated operational track record to continue driving capital efficiencies, maximizing returns and reducing risk. Together, we will accelerate America’s energy reach and fuel a more affordable, reliable and lower carbon future.

We are motivated by this opportunity for you, our shareholders, and the consumers and communities who benefit from the quality of life provided by natural gas.

Thank you for your investment and partnership.

2023 Annual Report – View full report

2024 Proxy Statement – View full report

(a) Our baseline includes those assets we owned at YE 2020: Eagle Ford, legacy Haynesville, legacy Marcellus and Powder River Basin. Methane emissions intensity calculated as volume methane emissions / volume gross operated natural gas produced.